Life Insurance Death Benefit Payout . How do we calculate the insurance needs of our dependants in the family? If you’re a life insurance. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. To secure coverage for yourself (or someone else),. More than half of american. How much coverage is considered enough?. Learn about the types, tax implications, and. What you need to know. A life insurance policy pays out a death benefit when an insured person dies.

from www.ftmfinancialservices.com

What you need to know. How much coverage is considered enough?. If you’re a life insurance. Learn about the types, tax implications, and. A life insurance policy pays out a death benefit when an insured person dies. How do we calculate the insurance needs of our dependants in the family? A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. To secure coverage for yourself (or someone else),. More than half of american.

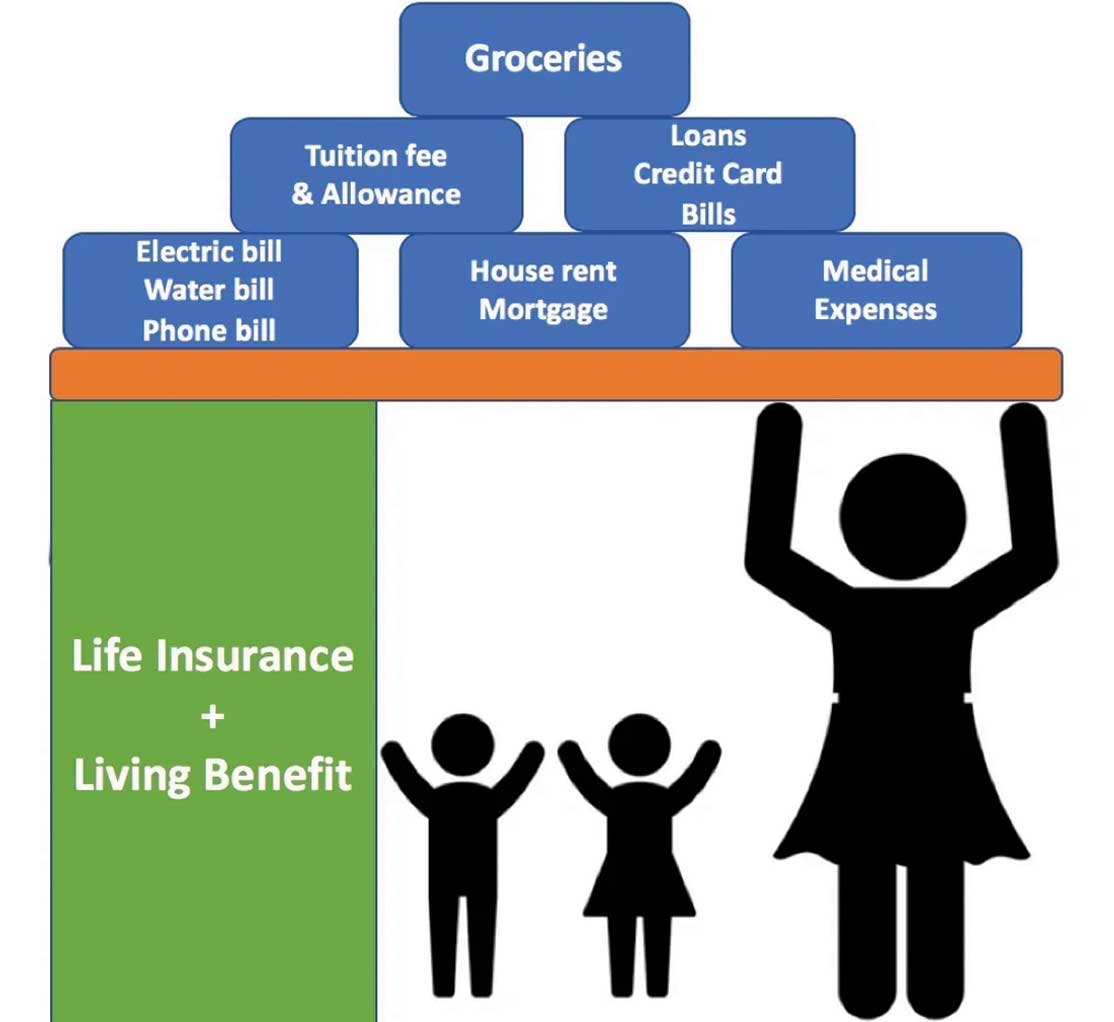

Life Insurance and Living Benefits FTM

Life Insurance Death Benefit Payout If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. How do we calculate the insurance needs of our dependants in the family? What you need to know. A life insurance policy pays out a death benefit when an insured person dies. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. More than half of american. For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. How much coverage is considered enough?. If you’re a life insurance. To secure coverage for yourself (or someone else),. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. Learn about the types, tax implications, and.

From hrs.wsu.edu

Life Insurance Open Enrollment Human Resource Services Human Resource Life Insurance Death Benefit Payout How much coverage is considered enough?. To secure coverage for yourself (or someone else),. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. How do we calculate the insurance needs of our dependants in the family? A life insurance death benefit is the. Life Insurance Death Benefit Payout.

From wholevstermlifeinsurance.com

Death Benefit Whole Vs Term Life Life Insurance Death Benefit Payout To secure coverage for yourself (or someone else),. What you need to know. A life insurance policy pays out a death benefit when an insured person dies. For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. A death benefit is a payout to the beneficiary of a life. Life Insurance Death Benefit Payout.

From www.planforms.net

Death Benefit Claim Printable Pdf Download Life Insurance Death Benefit Payout Learn about the types, tax implications, and. A life insurance policy pays out a death benefit when an insured person dies. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. More than half of american. A life insurance death benefit is the payout your loved. Life Insurance Death Benefit Payout.

From enrichest.com

Understanding Life Insurance Death Payout How Your Loved Ones Benefit Life Insurance Death Benefit Payout For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. A death benefit is a payout to the beneficiary of a life insurance. Life Insurance Death Benefit Payout.

From guaranteedissuelife.com

What Is A Graded Death Benefit? 15 Insurance Carriers] Life Insurance Death Benefit Payout How do we calculate the insurance needs of our dependants in the family? For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. How much coverage is considered enough?. If you pass away, the life insurance company can pay out a death benefit to the person or persons you. Life Insurance Death Benefit Payout.

From www.alamy.com

Conceptual display Life Insurance. Conceptual photo Payment of death Life Insurance Death Benefit Payout A life insurance policy pays out a death benefit when an insured person dies. Learn about the types, tax implications, and. How much coverage is considered enough?. To secure coverage for yourself (or someone else),. More than half of american. For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to. Life Insurance Death Benefit Payout.

From medium.com

Accelerated Death Benefit Rider Unlock Your Life Insurance Payout Life Insurance Death Benefit Payout How do we calculate the insurance needs of our dependants in the family? What you need to know. Learn about the types, tax implications, and. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. A life insurance policy pays out a death benefit when an. Life Insurance Death Benefit Payout.

From www.dreamstime.com

Text Showing Inspiration Life Insurance. Business Approach Payment of Life Insurance Death Benefit Payout Learn about the types, tax implications, and. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. A life insurance policy pays out a death benefit when an insured person dies. For dependants’ protection scheme, if date of death is before 01 apr 2021,. Life Insurance Death Benefit Payout.

From theinsuranceproblog.com

How to Read and Understand your Whole Life Insurance Statement • The Life Insurance Death Benefit Payout How do we calculate the insurance needs of our dependants in the family? For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. A life insurance policy pays out a death benefit when an insured person dies. How much coverage is considered enough?. To secure coverage for yourself (or. Life Insurance Death Benefit Payout.

From woodfieldfa.com

What good is 1,000,000 if you’re dead? Woodfield Financial Advisors Life Insurance Death Benefit Payout A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. If you’re a life insurance. A life insurance policy pays out a death benefit when an insured person dies. To secure coverage for yourself (or someone else),. More than half of american. For dependants’ protection scheme,. Life Insurance Death Benefit Payout.

From wholevstermlifeinsurance.com

Death Benefit Whole Vs Term Life Life Insurance Death Benefit Payout How do we calculate the insurance needs of our dependants in the family? To secure coverage for yourself (or someone else),. Learn about the types, tax implications, and. How much coverage is considered enough?. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. A life insurance policy pays. Life Insurance Death Benefit Payout.

From www.dreamstime.com

Sign Displaying Life Insurance. Business Approach Payment of Death Life Insurance Death Benefit Payout How much coverage is considered enough?. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. If you’re a life insurance. Learn about the types, tax implications, and. What you need to know. To secure coverage for yourself (or someone else),. For dependants’ protection scheme, if date of death. Life Insurance Death Benefit Payout.

From mygreenbucks.net

The Benefits of Life Insurance Go Beyond a Payout After Death Life Insurance Death Benefit Payout Learn about the types, tax implications, and. How do we calculate the insurance needs of our dependants in the family? If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. A death benefit is a payout to the beneficiary of a life insurance policy,. Life Insurance Death Benefit Payout.

From www.signnow.com

Life Death Claim 20102024 Form Fill Out and Sign Printable PDF Life Insurance Death Benefit Payout How much coverage is considered enough?. What you need to know. More than half of american. Learn about the types, tax implications, and. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. If you pass away, the life insurance company can pay out a death benefit to the. Life Insurance Death Benefit Payout.

From www.dreamstime.com

Death Benefit Payout To the Beneficiary of a Life Insurance Policy Life Insurance Death Benefit Payout Learn about the types, tax implications, and. What you need to know. For dependants’ protection scheme, if date of death is before 01 apr 2021, please follow steps 1 to 2 to submit. A life insurance death benefit is the payout your loved ones receive if you die while your policy is in force. If you’re a life insurance. How. Life Insurance Death Benefit Payout.

From www.policygenius.com

What Happens When Your Life Insurance Beneficiary Dies Before You? Life Insurance Death Benefit Payout What you need to know. To secure coverage for yourself (or someone else),. A life insurance policy pays out a death benefit when an insured person dies. More than half of american. If you’re a life insurance. How much coverage is considered enough?. A life insurance death benefit is the payout your loved ones receive if you die while your. Life Insurance Death Benefit Payout.

From audit.policybachat.com

All you need to know about Life Insurance Death Benefits PolicyBachat Life Insurance Death Benefit Payout What you need to know. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. A life insurance policy pays out a death benefit when an insured person dies. If you pass away, the life insurance company can pay out a death benefit to the person. Life Insurance Death Benefit Payout.

From www.awesomefintech.com

Death Benefit AwesomeFinTech Blog Life Insurance Death Benefit Payout How much coverage is considered enough?. If you pass away, the life insurance company can pay out a death benefit to the person or persons you named as beneficiaries of the policy. More than half of american. What you need to know. Learn about the types, tax implications, and. For dependants’ protection scheme, if date of death is before 01. Life Insurance Death Benefit Payout.